Corporate Compliance Management Services

Manage your compliance with the help of Interfacing's BPM Professionals. Get advice from our consultants now!Corporate Compliance Management Services

Compliance was established to ensure that organizations act responsibly. There are several considerable benefits to be achieved with Corporate Compliance Management. For one, compliance actively fosters positive public opinion about an organization, opening up numerous opportunities that businesses with poor reputation or public image cannot access. It is also a vital element of the internal control process of any organization, helping control content and reduce costs.

Key Aspects of Compliance Management

Compliance management is often divided into three key components:

Finance & Audit

Where compliance with finance – and internal audit-related decree is managed.

Information Technology

Where compliance with all information technology and communication mandates as well as organizational objectives is managed.

Legal

Which essentially ties the three aspects together with the help of the legal department and the chief compliance officer.

The chief compliance officer identifies all relevant compliance requirements such as these and proceeds with compliance management. He or she also identifies organizations’ short and long-term plans in relation to meeting the compliance requirements of the above-mentioned regulations and more. In line with the principles of compliance management, strategies and step-by-step guidelines are created for meeting the goals.

What is Compliance Management?

Compliance was established to ensure that organizations act responsibly. There are several considerable benefits to be achieved by doing so. For one, compliance actively fosters positive public opinion about an organization, opening up numerous opportunities that businesses with poor reputation or public image cannot access. It is also a vital element of the internal control process of any organization, helping control content and reduce costs.

Compliance with internal policies, especially those related to workplace safety, wages, compensation, rewards and benefits, has a direct impact on employee morale, motivation and productivity, which has its own set of business benefits.

Compliance management is the umbrella term for the approach, function and activities an organization undertakes to comply with legislation, industry regulation/best practices and policies.

It typically includes a set of key tasks, some of which are listed below:

- Identification of the relevant compliance requirements for the organization (defined for instance, in regulations, laws, contracts, strategies and policies of the organization);

- Assessment of the state of compliance within different organizational functions and departments;

- Estimation of expenses to achieve the state of total compliance;

- Estimation of the costs and risks of non-compliance;

- Comparison of cost of non-compliance against expenses for compliance;

- Identification of high-priority compliance tasks and corrective actions deemed necessary after the cost-expense analysis;

- Fund allocation and initiation of tasks;

- Monitoring and management of the compliance tasks.

In addition, the chief compliance officer works with executive managers from other departments, including HR to outline ethical and legal behavior among employees, and create plans of action to promote such behavior. Strategies are put in place to deal with defaulters, depending upon the severity of non-compliance.

Compliance Management Support

The ability to audit, assess, and document evidence that business processes meet the required standards are just some of the key elements to these regulations. Interfacing’s Enterprise Process Center (EPC) provides you with a tool to control your compliance processes by helping you manage the audit, assessment and execution of your underlying business process management. This will make compliance easier and more transparent throughout your organization.

Enterprise Process Center will give your company the ability to automatically and continuously monitor and manage your compliance initiatives. Implementing controls associated with processes and tasks ensures that compliance requirements are followed, while automatic tracking and documentation of all process changes gives management complete oversight.

Compliance Support Features:

- Implement key compliance processes in a visual and easy-to-understand manner

- Support the audit of key processes

- Manage process and document lifecycles

- Define and evaluate controls

- Link risk control plans to process controls

- Develop compliance reports

Why Interfacing?

With Interfacing, you gain access to Enterprise Process Center (EPC), a comprehensive suite of tools that not only keep you compliant but also drive continuous improvement.

Elevate your corporate compliance experience with a partner that understands the intricacies of your industry and empowers you to navigate the regulatory journey confidently—choose Interfacing, where compliance meets innovation.

Contact us more for information.

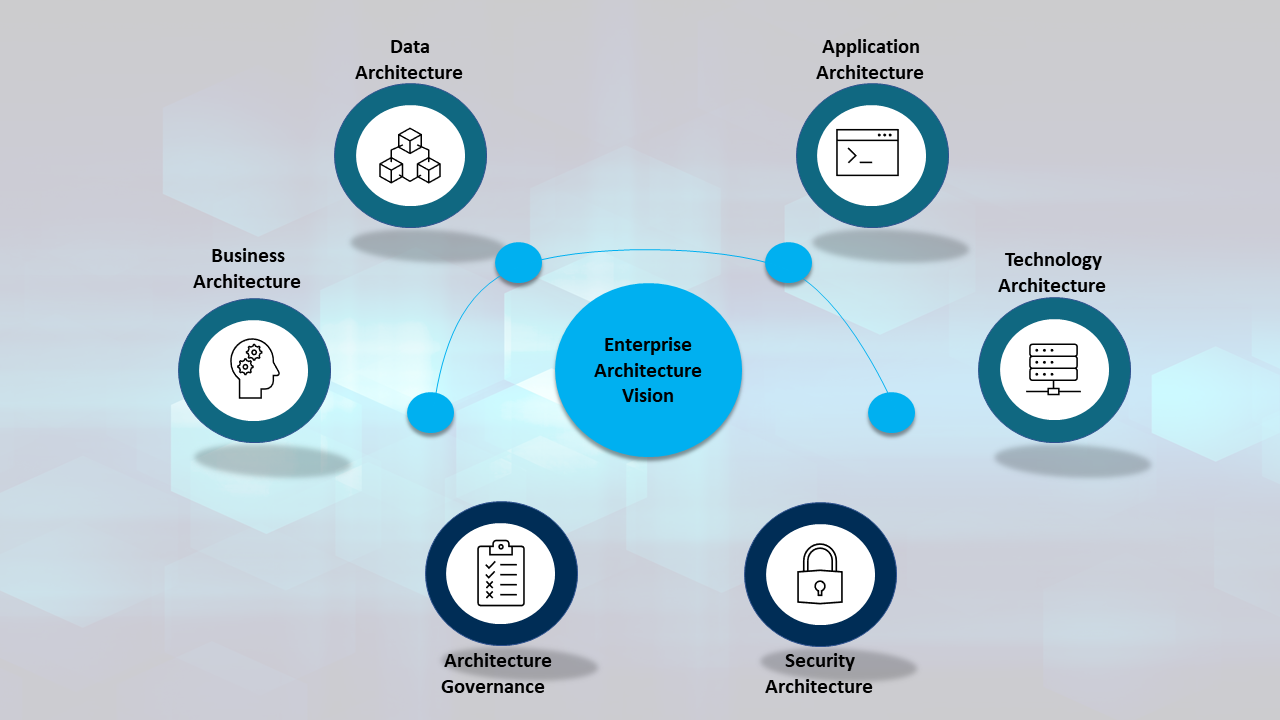

Enterprise Architecture Services

Professionals at Interfacing can help you and your organization implement the right Enterprise Architecture for your industry and business.

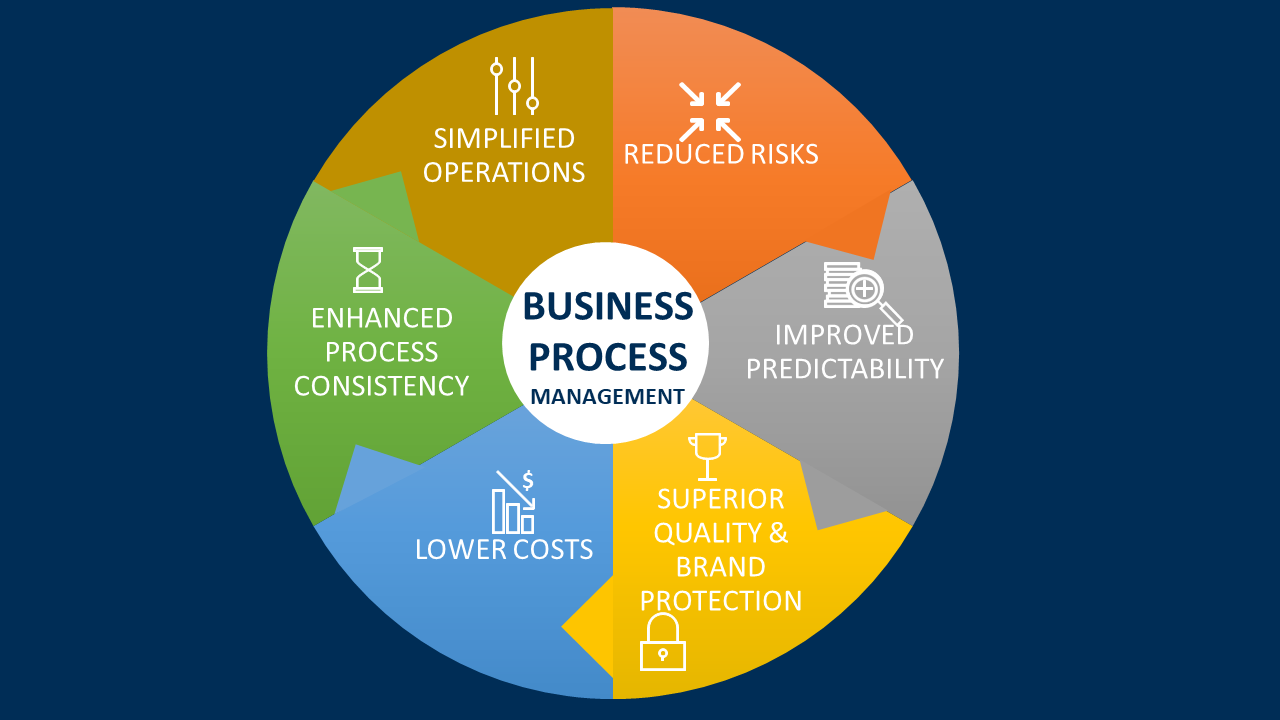

Business Process Management Services

Interfacing experts are on hand to assist with analizing, defining and modeling to prioritize opportunities and issues that provide complete reporting and support for a strong BPM strategy and roadmap.

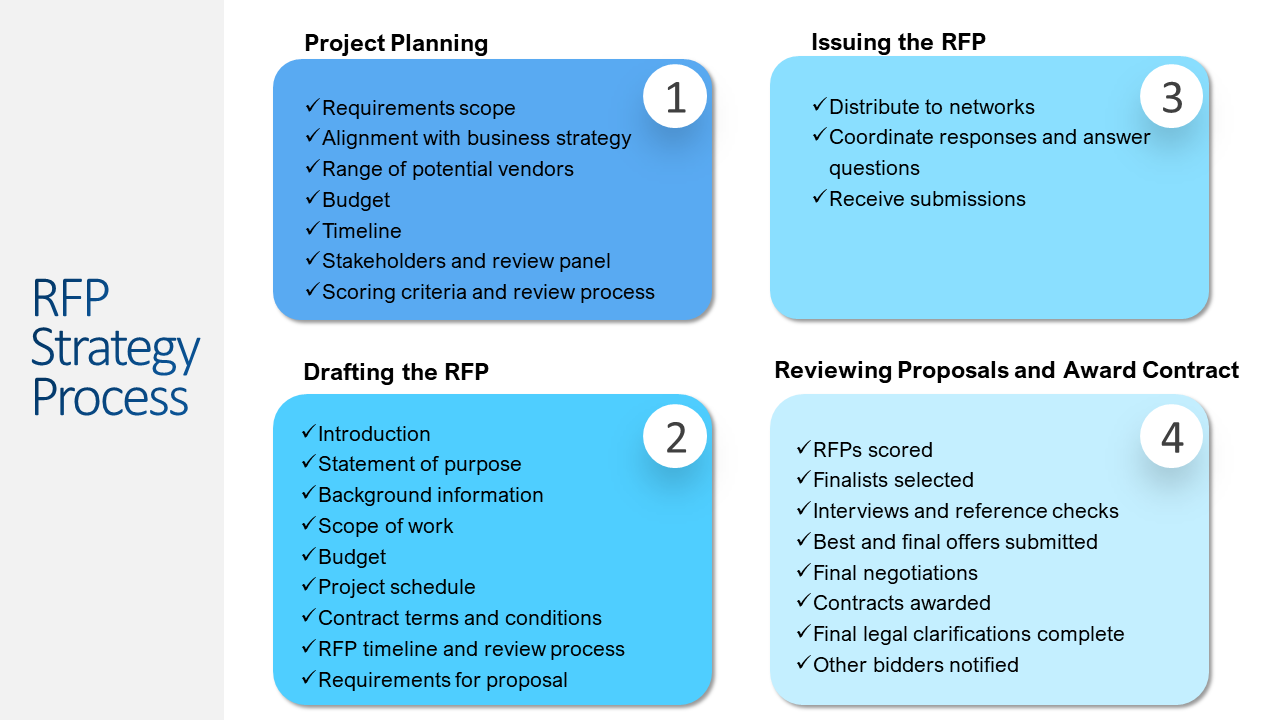

RFP Strategy Development

Interfacing Consultants have extensive experience with:

- Conducting RFPs and responding to RFPs.

- Identifying and defining the scope of key projects,

- Identifying business requirements and selection criteria

Read Our Blogs

Take a moment to read blogs about GXP, Regulatory Compliance, today’s trends, and much much more!

Discover how we helped other companies succeed

Contact us Today for a Free Consultation!

If you are interested in our Corporate Compliance Management services, please contact us today for a free consultation. We will assess your current situation, identify your needs and goals, and propose a customized solution for you. We look forward to hearing from you and helping you with your Corporate Compliance project.