- Business Process Management (BPM)Document Management System (DMS)Electronic Quality Management System (QMS)Risk, Governance & Compliance (GRC)Low Code Rapid Application Development (LC)Business Continuity Management (BCM)Enterprise Architecture (EA)Business Process Management (BPM)Document Management System (DMS)

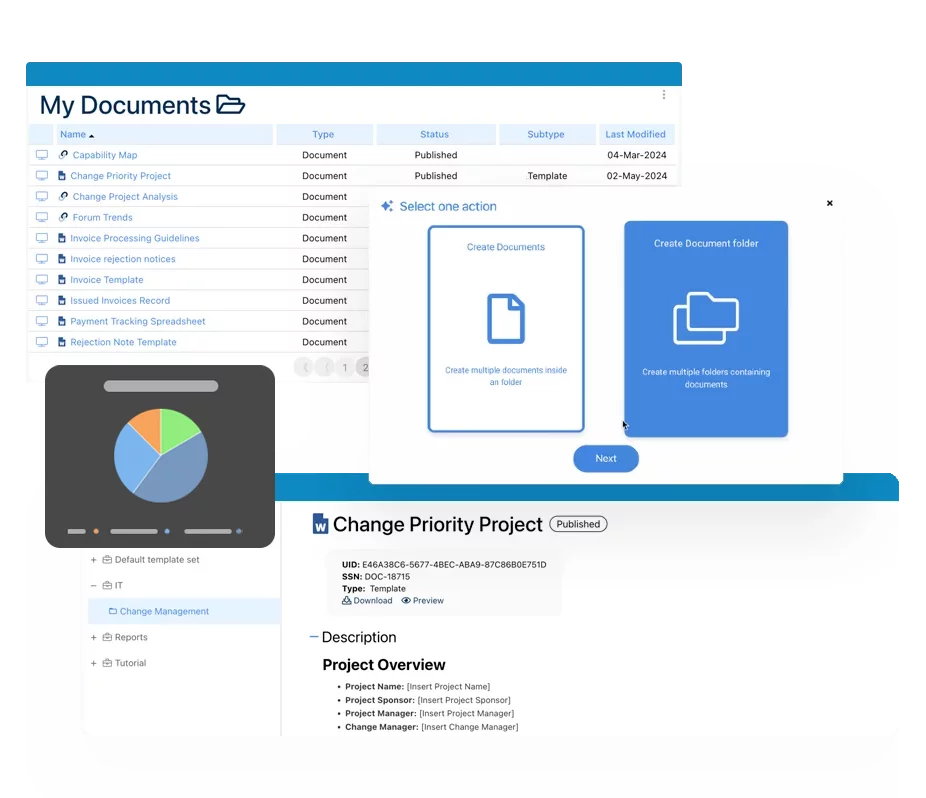

- Document Control Overview

- AI Content Creation & Improvement

- Policy & Procedure Management (SOP)

- AI Content Mining Parser

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

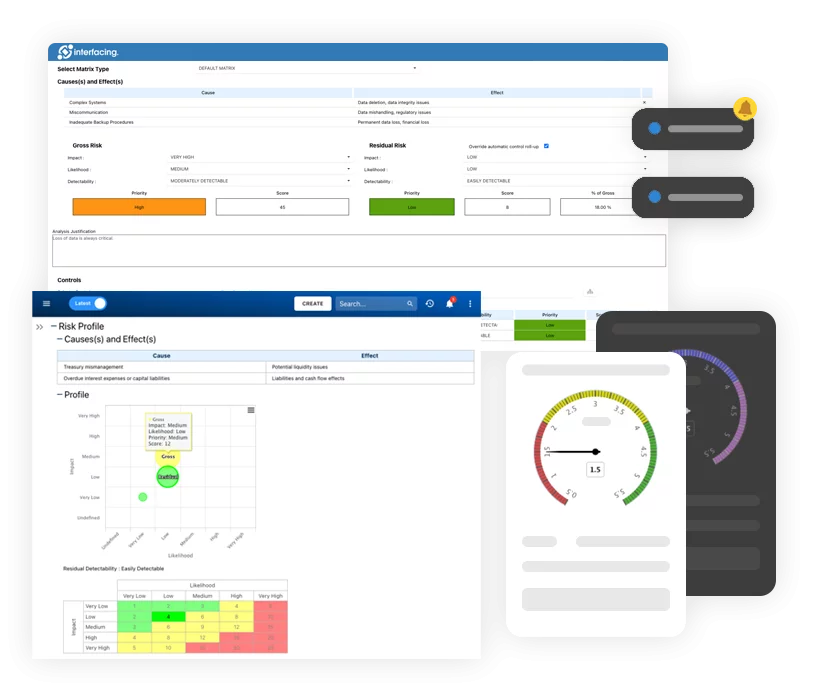

Electronic Quality Management System (QMS)

Electronic Quality Management System (QMS)- Quality Management System Overview

- Document Control & Records Management

- Audit & Accreditation Management

- Corrective & Preventative Action

- Quality Event (Non-conformity / Complaint/ Compliance)

- Risk Management

- Incident Management

- Environmental Health & Safety

- Product & Supplier Management (SCAR)

- Training Management

- Control Management

- Action Items Management

- Management Review

- FMEA

- Pharmacovigilance

- Data Migration & Integration

Risk, Governance & Compliance (GRC)

Risk, Governance & Compliance (GRC)- Risk, Governance & Compliance Overview

- Risk & Control Management

- Regulatory Compliance

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

Low Code Rapid Application Development (LC)

Low Code Rapid Application Development (LC)- Low Code Automation Platform Overview

- Electronic Web Form Design (eFORMS)

- Database Table Entity Designer

- System Integration Designer

- Design & Manage Tasks

- Design & Manage BPMS Apps

- Custom Rules/Guards/Actions

- Electronic Services

- User Homepage

- BAM (Business Activity Monitoring)

- Custom Dashboard Design

- Data Migration & Integration

Business Continuity Management (BCM)

Business Continuity Management (BCM)- Business Continuity Management Overview

- Business Impact Analysis

- Disaster Recovery Simulation

- Action Item Management

- Mass Notification Management

- Asset Management

- Interfacing Offline App

Enterprise Architecture (EA)

Enterprise Architecture (EA) - IndustriesRegulatory ComplianceUse CasesLearning CenterFramework & PracticesIndustries

- Healthcare

- Medical Device Technology

- Life Science, Pharmaceutical

- Aerospace & Defense

- Airlines and Aviation

- Media & Telecommunications

- Government and Military

- Technology

- Energy

- Logistics & Port Operations

- Banking & Capital Markets

- Retail & Consumer

- Consulting

- Education

- Engineering & Construction

- Manufacturing

- Financial Services

- Insurance

- Chemicals

Regulatory Compliance- Regulatory Compliance

- ISO

- ISO 9001 (guide)

- ISO 9001:2026 (preparation)

- ISO 17025

- ISO 27000

- ISO 27001

- ISO27002

- ISO 42001

- EU AI Act

- SOC 2 Type 1 & 2

- Sarbanes Oxley

- GxP

- GRC

- Basel

- Digital Signature

- GDPR

- IFRS

- NIST SP 800-53

Use Cases

Use Cases- Quality Management System (QMS)

- Digital Transformation

- Continuous Improvement

- Governance, Risk & Compliance

- Knowledge Management

- System Deployment (ERP, CRM…)

Learning CenterFramework & Practices

Learning CenterFramework & Practices - AboutCustomer SuccessPartners

Basel Compliance

Please Select contact form.

Learn how Interfacing can help you with Basel Compliance for Basel 3 & Basel 1 2 3.

Basel Compliance

Basel 3 asks organizations to implement a corporate risk management system that accounts for operational risks. Basel 3 requires financial organizations to set aside regulatory capital for operational risk – an important development that affects most financial service institutions worldwide.

Basel Compliance: A closer look at the advantages of Basel 3 & Basel 1 2 3

Ensure Transparency

Know where ressources are being used and encourage efficient work and habits by planning well in advance

Orchestrate Technology

Implement service orchestration to design more flexible communications networks that mirror the efficients of your business process management

Manage Workflow

Integrate your people, processes, and technology by taking advantage of our workflow engine to deliver work to where it’s needed, and keep all employees up to date with the most important priorities

Portable Process Manuals

Ability to generate a complete output of your processes and all of the related information that is ready for print. A collaborative tool that allows your agents to share information more widely

Implement Standard Methodologies

Avoid the need for continual trial and error in improving your client’s operational efficiency; get a head start by taking advantage of industry standards

Compliance

Our process methodology and support for business rules and risk/control management allows effective process design that has all the appropriate checks and balances.

Encourage Collaboration

By uniting goals and creating a common framework for your clients, they will be able to cooperate at a previously unattained level.

Utilize Resources

Business process management will expose unused resources and allow you to take better advantage of them along the lengh of the process.

From a BPM perspective, the standards of Basel 3 have increased pressure on:

From a BPM perspective, the standards of Basel 3 have increased pressure on:

- Tracking capital adequacy,

- Measuring and maximizing profitability, and

- Streamlining systems from a Business Process Management (BPM) perspective

It is based on three pillars:

It is based on three pillars:

- Minimum capital requirements

- Supervisory review

- Market discipline

Basel Compliance Process

Basel 3, or The New Accord (based on the original Basel Accord), was created to improve the way financial organizations and regulators approach risk management. Its goal was to revise the international standards for measuring capital and to introduce a more formal approach to measuring and managing operational risk.

Why Choose Interfacing?

With over two decades of AI, Quality, Process, and Compliance software expertise, Interfacing continues to be a leader in the industry. To-date, it has served over 500+ world-class enterprises and management consulting firms from all industries and sectors. We continue to provide digital, cloud & AI solutions that enable organizations to enhance, control and streamline their processes while easing the burden of regulatory compliance and quality management programs.

To explore further or discuss how Interfacing can assist your organization, please complete the form below.

Documentation: Driving Transformation, Governance and Control

• Gain real-time, comprehensive insights into your operations.

• Improve governance, efficiency, and compliance.

• Ensure seamless alignment with regulatory standards.

eQMS: Automating Quality & Compliance Workflows & Reporting

• Simplify quality management with automated workflows and monitoring.

• Streamline CAPA, supplier audits, training and related workflows.

• Turn documentation into actionable insights for Quality 4.0

Low-Code Rapid Application Development: Accelerating Digital Transformation

• Build custom, scalable applications swiftly

• Reducing development time and cost

• Adapt faster and stay agile in the face of

evolving customer and business needs.

AI to Transform your Business!

The AI-powered tools are designed to streamline operations, enhance compliance, and drive sustainable growth. Check out how AI can:

• Respond to employee inquiries

• Transform videos into processes

• Assess regulatory impact & process improvements

• Generate forms, processes, risks, regulations, KPIs & more

• Parse regulatory standards into requirements

Request Free Demo

Document, analyze, improve, digitize and monitor your business processes, risks, regulatory requirements and performance indicators within Interfacing’s Digital Twin integrated management system the Enterprise Process Center®!

Trusted by Customers Worldwide!

More than 400+ world-class enterprises and management consulting firms