- Gestión de Procesos de Negocio (BPM)Sistema de Gestión de Documentos (SGD)Sistema electrónico de gestión de la calidad (SGC)Riesgo, Gobernanza y Cumplimiento (GRC)Desarrollo rápido de aplicaciones de bajo código (LC)Gestión de la Continuidad de Negocio (BCM)Arquitectura Empresarial (EA)Gestión de Procesos de Negocio (BPM)

- Visión general de la gestión de procesos negocio

- Análisis, generación, análisis y mejora de procesos de IA

- Mapeo / Modelado de Procesos

- Análisis y mejora de procesos

- Simulación de procesos

- Minería de procesos

- Colaboración y gobernanza

- Data Migración e integración

- Aplicación offline de Interfacing

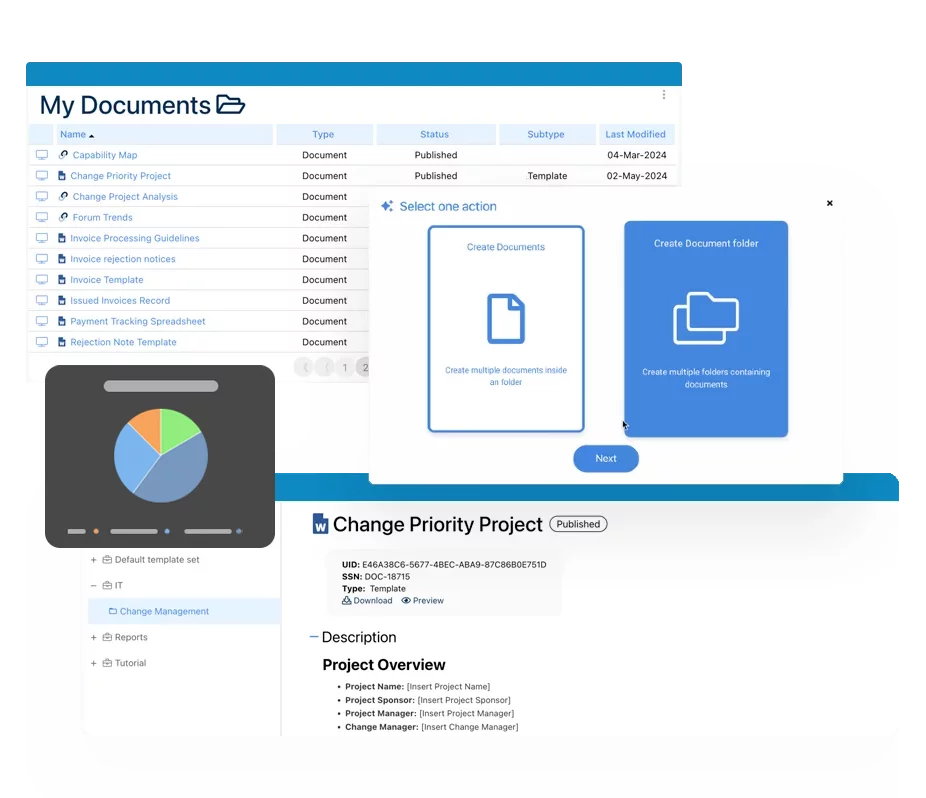

Sistema de Gestión de Documentos (SGD)

Sistema de Gestión de Documentos (SGD)- Visión general del control de documentos

- Creación y mejora de contenidos de IA

- Gestión de políticas y procedimientos (PNT)

- Colaboración y gobernanza

- Data Migración e integración

- Aplicación offline de Interfacing

Sistema electrónico de gestión de la calidad (SGC)

Sistema electrónico de gestión de la calidad (SGC)- Visión general del sistema de gestión de la calidad

- Control de Documentos y gestión de Registros

- Gestión de Auditoría y Acreditación

- Acción correctiva y preventiva

- Evento de calidad (No conforme/Quejas, Conformidad)

- Gestión de riesgos

- Gestión de incidentes

- Salud y seguridad medioambiental

- Gestión de productos y proveedores (SCAR)

- Gestión de la formación

- Gestión del Control

- Gestión de elementos de acción

- Revisión de la gestión

- FMEA

- Farmacovigilancia

- Data Migración e integración

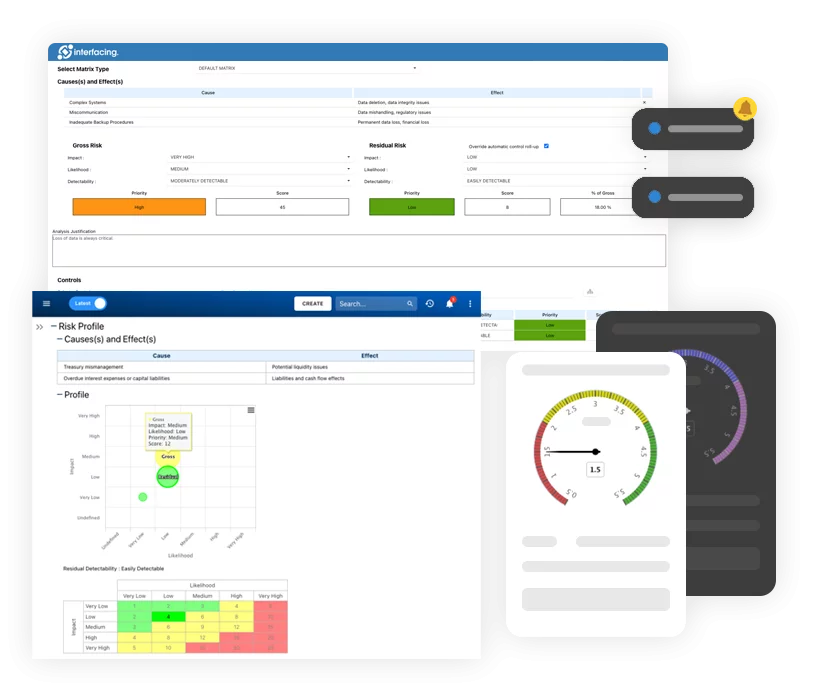

Riesgo, Gobernanza y Cumplimiento (GRC)

Riesgo, Gobernanza y Cumplimiento (GRC)- Visión general de Riesgo, Gobernanza y Cumplimiento

- Gestión de riesgos y control

- Cumplimiento de la normativa

- Colaboración y gobernanza

- Data Migración e integración

- Aplicación offline de Interfacing

Desarrollo rápido de aplicaciones de bajo código (LC)

Desarrollo rápido de aplicaciones de bajo código (LC)- Visión general de la plataforma de automatización Low Code

- Diseño de formularios web electrónicos (eFORMS)

- Visión general de la plataforma de automatización Low Code

- Diseñador de entidades de tabla de base de datos

- Diseñador de Integración de Sistemas

- Seguimiento y delegación de tareas

- Reglas/Guardias/Acciones personalizadas

- Servicios de mensajes de texto/voz

- BAM (Monitorización de la Actividad Empresarial)

- Data Migración e integración

Gestión de la Continuidad de Negocio (BCM)

Gestión de la Continuidad de Negocio (BCM)- Visión general de BCM

- Análisis del impacto empresarial

- Planificación de la continuidad de la actividad

- Simulación de recuperación en caso de catástrofe

- Gestión de elementos de acción

- Gestión de notificaciones masivas

- Gestión de activos

- Data Migración e integración

Arquitectura Empresarial (EA)

Arquitectura Empresarial (EA) Consulting Services

Interfacing está aquí para guiarle en cualquier iniciativa de transformación.

- IndustriasCumplimiento de la normativaCasos prácticosCentro de AprendizajeMarco y prácticasIndustrias

- Sanidad

- Tecnología de dispositivos médicos

- Ciencias de la vida, Farmacéutica

- Aeroespacial y Defensa

- Aerolíneas y aviación

- Medios de comunicación y telecomunicaciones

- Gobierno y Ejército

- Tecnología

- Energía

- Logística y Operaciones Portuarias

- Banca y mercados de capitales

- Comercio minorista y consumo

- Consulta

- Educación

- Ingeniería y construcción

- Fabricación

- Servicios financieros

- Seguros

- Productos químicos

Cumplimiento de la normativaCasos prácticosCentro de AprendizajeMarco y prácticas - Sobre nosotrosÉxito del clienteSociosSobre nosotrosÉxito del clienteSocios

Cumplimiento de Basilea

Please Select contact form.

Descubra cómo Interfacing puede ayudarle con el cumplimiento de Basilea para Basilea 3 y Basilea 1 2 3.

Cumplimiento de Basilea

Basilea 3 pide a las organizaciones que implementen un sistema de gestión de riesgos corporativos que tenga en cuenta los riesgos operativos. Basilea 3 requiere que las organizaciones financieras reserven capital regulatorio para el riesgo operativo, un desarrollo importante que afecta a la mayoría de las instituciones de servicios financieros en todo el mundo.

Cumplimiento de Basilea: una mirada más cercana a las ventajas de Basilea 3 y Basilea 1 2 3

Garantizar la transparencia

Sepa dónde se están utilizando los recursos y fomente el trabajo y los hábitos eficientes planificando con mucha anticipación

Organizar la tecnología

Implemente la coordinación de servicios para diseñar redes de comunicaciones más flexibles que reflejen la eficacia de la gestión de sus procesos empresariales.

Administrar flujo de trabajo

Integre a su gente, procesos y tecnología aprovechando nuestro motor de flujo de trabajo para entregar el trabajo donde se necesita y mantener a todos los empleados actualizados con las prioridades más importantes.

Manuales portátiles de procesos

Posibilidad de generar una salida completa de sus procesos y toda la información relacionada, lista para imprimir. Una herramienta colaborativa que permite a sus agentes compartir información de manera más amplia.

Implementar metodologías estándares

Evite la necesidad de prueba y error continuos para mejorar la eficiencia operativa de su cliente; Obtenga una ventaja al aprovechar los estándares de la industria

Cumplimiento

Nuestra metodología de procesos y el apoyo a las reglas de negocio y a la gestión de riesgos y controles permiten un diseño de procesos eficaz que cuenta con todas las comprobaciones y controles adecuados.

Fomentar la colaboración

Al unir objetivos y crear un marco común para sus clientes, podrán cooperar a un nivel previamente no alcanzado.

Utilizar recursos

La gestión de procesos comerciales expondrá los recursos no utilizados y le permitirá aprovecharlos mejor a lo largo del proceso.

En BPM, Basilea 3 aumenta la presión sobre:

En BPM, Basilea 3 aumenta la presión sobre:

- Seguimiento de la adecuación del capital,

- Medir y maximizar la rentabilidad, y

- Optimización de sistemas desde una perspectiva de gestión de procesos de negocio (BPM)

Se basa en tres pilares:

Se basa en tres pilares:

- Requisitos mínimos de capital

- Revisión de supervisión

- Disciplina de mercado

Proceso de cumplimiento de Basilea

Basilea 3, o El Nuevo Acuerdo (basado en el Acuerdo de Basilea original), se creó para mejorar la forma en que las organizaciones financieras y los reguladores enfocan la gestión del riesgo. Su objetivo era revisar las normas internacionales para medir el capital e introducir un enfoque más formal para medir y gestionar el riesgo operativo.

¿Por qué elegir Interfacing?

Con más de dos décadas de experiencia en software de IA, Calidad, Procesos y Cumplimiento, Interfacing sigue siendo líder en el sector. Hasta la fecha, ha prestado servicio a más de 500 empresas de talla mundial y consultoras de gestión de todas las industrias y sectores. Seguimos ofreciendo soluciones digitales, en la nube y de IA que permiten a las organizaciones mejorar, controlar y agilizar sus procesos, al tiempo que alivian la carga de los programas de cumplimiento normativo y gestión de la calidad.

Para obtener más información o hablar sobre cómo Interfacing puede ayudar a su organización, rellene el siguiente formulario.

Documentación: Impulsando la Transformación, Gobernanza y Control

• Obtenga información integral en tiempo real sobre sus operaciones.

• Mejore la gobernanza, eficiencia y cumplimiento.

• Garantice la alineación fluida con los estándares regulatorios.

eQMS: Automatización de flujos de trabajo y reportes de calidad y cumplimiento

• Simplifique la gestión de calidad con flujos de trabajo automatizados y monitoreo..

• Optimice CAPA, auditorías de proveedores, capacitaciones y flujos relacionados..

• Transforme la documentación en información procesable para Calidad 4.0.

.

Desarrollo rápido de aplicaciones low-code: Acelerando la transformación digital

• Cree aplicaciones personalizadas y escalables de forma ágil.

• Reduzca el tiempo y costo de desarrollo.

• Adáptese rápidamente y manténgase ágil frente a las necesidades cambiantes de clientes y negocios.

¡IA para transformar su negocio!

Las herramientas impulsadas por IA están diseñadas para optimizar operaciones, mejorar el cumplimiento y fomentar el crecimiento sostenible. Descubra cómo la IA puede:

• Responder a las consultas de los empleados.

• Transformar videos en procesos.

• Formular recomendaciones sobre el impacto de la regulación y la mejora de los procesos

• Generar formularios electrónicos, procesos, riesgos, regulaciones, KPIs y mucho más.

• Desglosar estándares regulatorios en requisitos desagregados.

Solicite una demostración gratuita

Con la confianza de Clientes en todo el mundo

Más de 400+ empresas y consultoras de gestión de talla mundial

Integración

Con la confianza de Clientes en todo el mundo Integración

Más de 400+ empresas y consultoras de gestión de talla mundial