A unified European framework transforming how financial institutions govern ICT risk, operational resilience, and third-party oversight.

Understanding DORA in Practical Terms

The Digital Operational Resilience Act represents one of the EU’s most ambitious attempts to modernize financial-sector governance. Rather than layering yet another set of cybersecurity rules on top of existing frameworks, DORA consolidates the operational backbone of financial organizations—technology, risk, continuity, and third-party oversight—into a single regulatory model.

At its core, DORA is about demonstrating that the institution can continue to operate even when technology fails. Not just by having backups or basic security controls, but by proving a deep, structural understanding of how business services rely on systems, data, vendors, and people.

Many organizations assume they are “mostly ready” because they have ISO 27001 or an established cybersecurity program. This assumption breaks down quickly. DORA’s scope extends far beyond cyber practices: it reaches into governance, scenario-based resilience testing, incident classification models, contractual standards with third parties, and the traceability of operational dependencies. It forces organizations to articulate, in defensible detail, how they will stay operational when critical technology stops working.

Why DORA Is Such a Turning Point

Financial institutions have always understood operational risk, but few have truly mapped how their digital ecosystems support their business processes. DORA shifts operational resilience from a technical function to an enterprise-wide obligation.

What makes DORA impactful is not the introduction of new concepts, but the demand for coherence across previously disconnected areas. Governance frameworks must align with real operational behavior. Process owners must understand their technological dependencies. Board members are now accountable for ICT resilience. Incident response requires consistent classification and reporting, not ad-hoc logging. Third-party oversight must extend beyond contracts and into operational impact.

In practice, DORA exposes weaknesses that most organizations already suspect exist: outdated continuity plans, unreliable system inventories, fragmented risk registers, and vendor files that have not been updated in years. Regulators are no longer accepting fragmented answers. They want a unified operational picture that demonstrates resilience, not just documentation.

Who Is Actually Covered by DORA?

Although framed as a financial-sector regulation, DORA’s influence extends far beyond banks. It applies across the financial ecosystem—insurance, investment firms, asset managers, payment providers, crypto-asset service providers—and, importantly, to critical ICT service providers that support them.

This means the compliance burden is shared between institutions and the technology vendors they rely on. Cloud providers, software platforms, and managed service organizations supporting critical functions now fall within the regulatory line of sight. For the first time, ICT firms that once operated outside direct financial regulation may face EU-level scrutiny regarding resilience, continuity, and incident transparency.

What DORA Actually Requires (Beyond the Text of the Regulation)

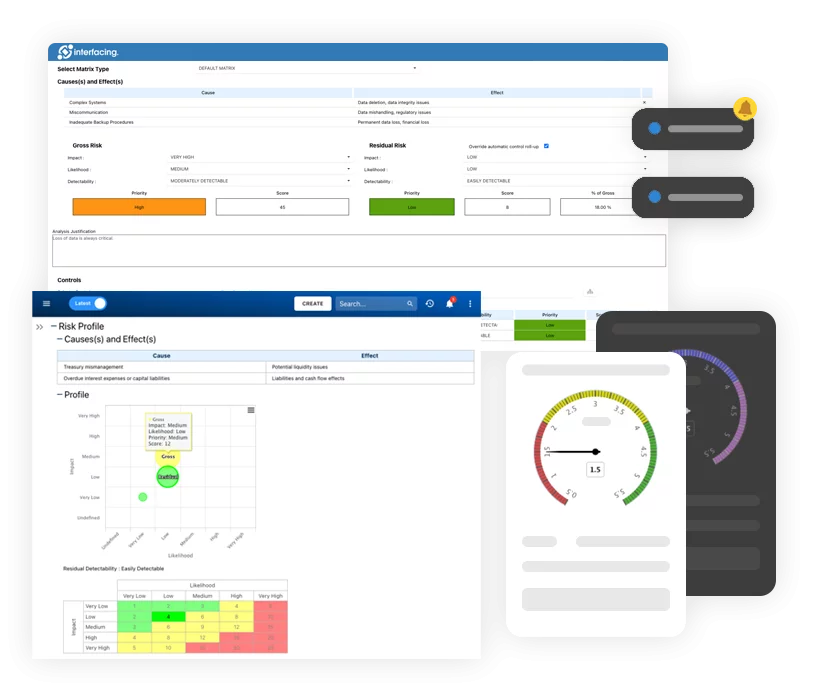

DORA’s requirements are often summarized as a checklist—risk management, incident reporting, resilience testing, third-party oversight—but in practice, these components function as an interconnected ecosystem.

Institutions must articulate how ICT risks are governed, monitored, mitigated, and escalated. They must classify incidents consistently and report severe events using standardized timelines. They must plan, test, and validate their resilience capabilities, not only through tabletop exercises but through scenario-based simulations and, for larger institutions, threat-led penetration testing.

Perhaps the most complex requirement involves third-party oversight. Organizations must understand not only who their vendors are, but what dependencies those vendors create, how failures would cascade through operations, and what assurance exists that those providers can withstand disruptions of their own.

None of these activities can occur in isolation. A continuity plan that is not aligned with process owners and technology inventories will fail under stress. Vendor assessments that are not linked to operational impact will not satisfy regulators. Risk registers that live in spreadsheets cannot demonstrate real-time governance. DORA requires an operational model that is integrated, traceable, and explainable.

Preparing for DORA: The Shift from Documents to Evidence

Organizations preparing for DORA often begin by reviewing their documentation. But DORA is not a documentation exercise. It is an evidence exercise. Regulators are not interested in whether policies exist; they care whether the organization lives by them.

This means institutions must be able to show how business processes depend on ICT assets, how controls are applied and monitored, how incidents evolve and escalate, and how continuity strategies correspond to operational realities. It means understanding how a failure in a single vendor or system would affect the larger value chain—and having a defensible answer for how the institution would maintain service.

Most gaps are not technical—they are structural. Dependencies are not documented in a unified way. Incident logs are inconsistent. Ownership responsibilities differ between teams. Risk and continuity speak different languages. Vendor files are static and not aligned with operational impact.

Preparing for DORA requires building connective tissue between these elements. Institutions that succeed typically adopt an integrated management system approach, where operational data lives in one governed framework rather than scattered across individual departments.

The Real-World Challenges Institutions Face

In practice, the hardest part of DORA compliance is not meeting the technical expectations—it is establishing transparency across the organization.

Institutions often discover that their internal view of operations does not match reality. Processes rely on undocumented systems. Systems rely on vendors that procurement has not reviewed in years. Continuity plans assume capabilities that no longer exist. Risk assessments reference outdated controls.

The problem is not bad practice—it is that operational complexity has grown faster than governance structures. DORA forces a recalibration. It compels organizations to replace assumptions with evidence, and narratives with traceability.

This is why DORA is transformative: it forces institutions to understand themselves in ways they never had to before.

Where AI Strengthens DORA Resilience

AI becomes particularly useful in areas where manual governance breaks down. It can detect gaps in documentation, highlight missing links between systems and processes, classify incidents consistently, and analyze regulatory updates to identify relevant impacts. When used effectively, AI reveals structural weaknesses that would otherwise remain hidden.

However, AI does not replace governance—it amplifies it. Institutions still need structure, ownership, and controlled workflows. AI simply accelerates the discovery and validation of the elements regulators expect to see.

How Interfacing Helps Organizations Meet DORA Requirements

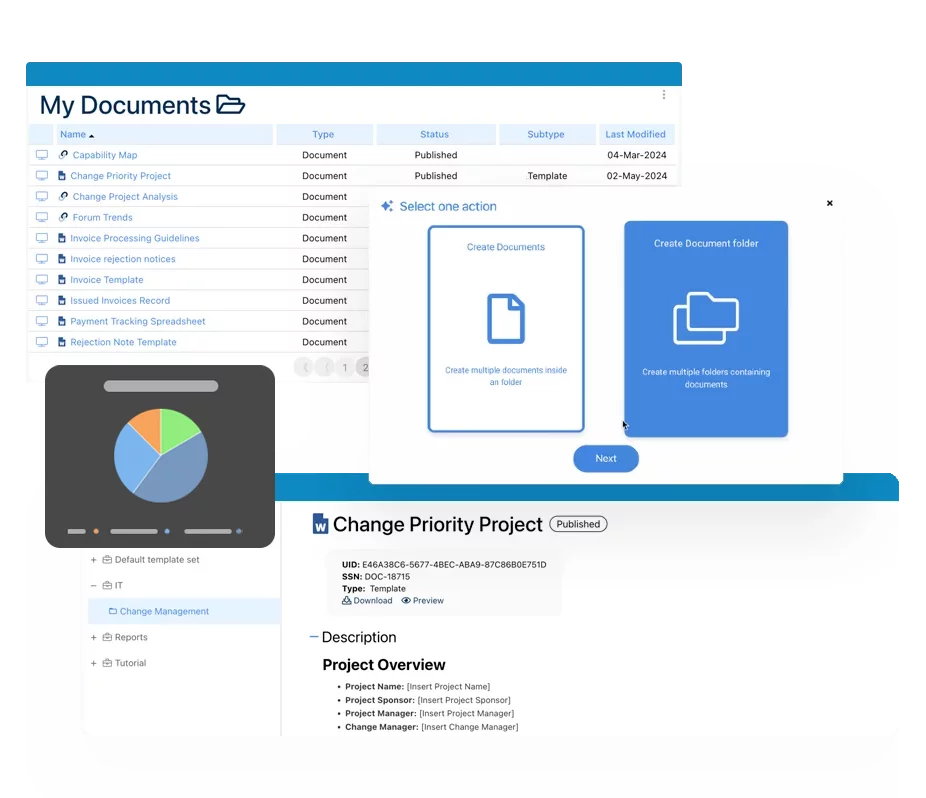

Interfacing’s AI-powered Integrated Management System (IMS) provides the unified structure that DORA expects. It connects processes, risks, controls, assets, vendors, documents, and continuity plans within a single governed framework. This eliminates the fragmentation that makes DORA compliance difficult.

With Interfacing, organizations can map their digital ecosystem, visualize dependencies, automate workflows, classify and escalate incidents, manage evidence, and build an audit-ready operational picture. The platform supports everything from impact analysis to board-level reporting, ensuring that what regulators ask for is always traceable, current, and defensible.

Instead of piecing together DORA compliance across multiple disconnected systems, institutions operate from a single source of truth—strengthening resilience while reducing the burden of ongoing compliance.

Request Demo

https://interfacing.com/ai-integrated-management-system

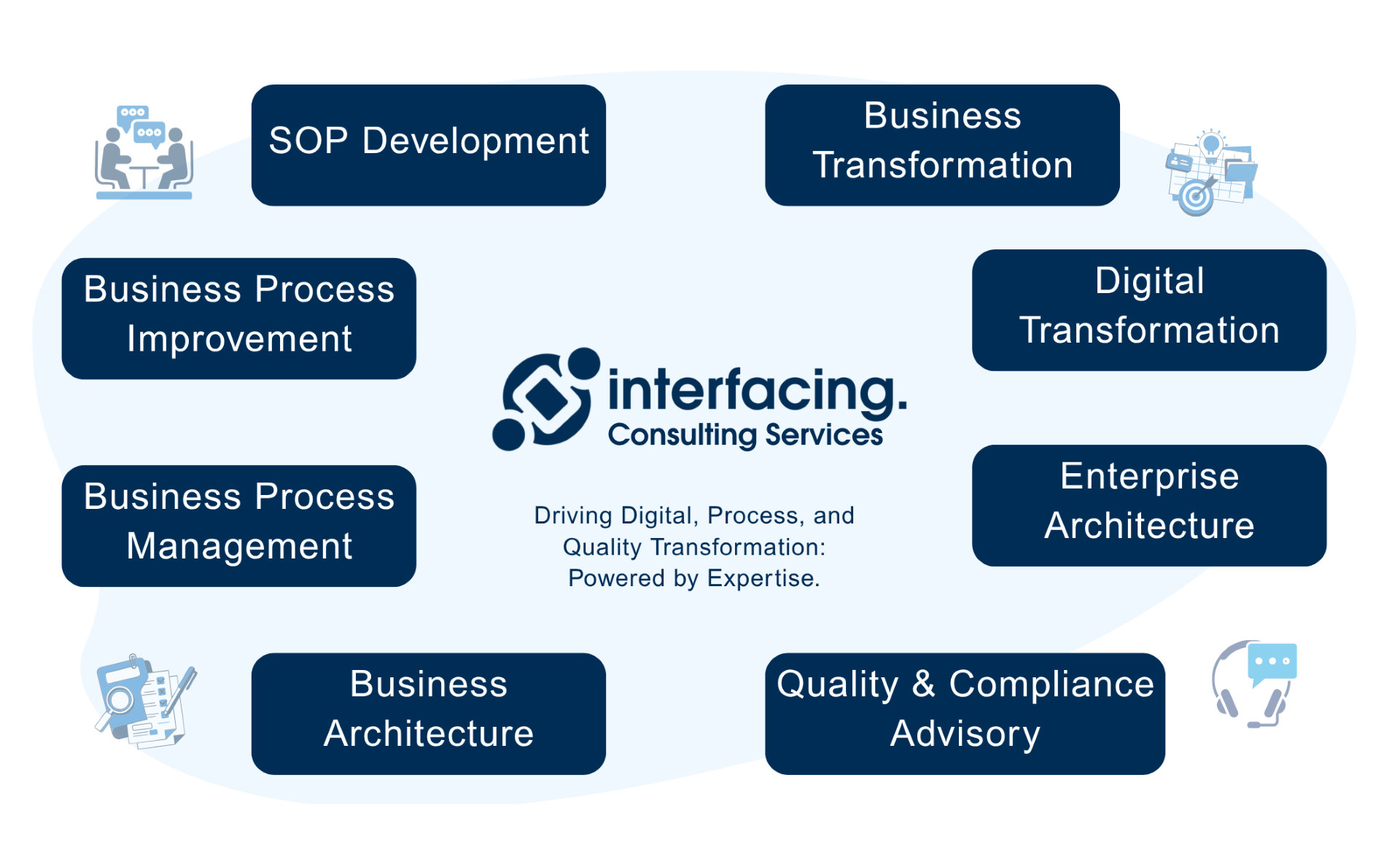

Why Choose Interfacing?

With over two decades of AI, Quality, Process, and Compliance software expertise, Interfacing continues to be a leader in the industry. To-date, it has served over 500+ world-class enterprises and management consulting firms from all industries and sectors. We continue to provide digital, cloud & AI solutions that enable organizations to enhance, control and streamline their processes while easing the burden of regulatory compliance and quality management programs.

To explore further or discuss how Interfacing can assist your organization, please complete the form below.

Documentation: Driving Transformation, Governance and Control

• Gain real-time, comprehensive insights into your operations.

• Improve governance, efficiency, and compliance.

• Ensure seamless alignment with regulatory standards.

eQMS: Automating Quality & Compliance Workflows & Reporting

• Simplify quality management with automated workflows and monitoring.

• Streamline CAPA, supplier audits, training and related workflows.

• Turn documentation into actionable insights for Quality 4.0

Low-Code Rapid Application Development: Accelerating Digital Transformation

• Build custom, scalable applications swiftly

• Reducing development time and cost

• Adapt faster and stay agile in the face of

evolving customer and business needs.

AI to Transform your Business!

The AI-powered tools are designed to streamline operations, enhance compliance, and drive sustainable growth. Check out how AI can:

• Respond to employee inquiries

• Transform videos into processes

• Assess regulatory impact & process improvements

• Generate forms, processes, risks, regulations, KPIs & more

• Parse regulatory standards into requirements

Request Free Demo

Document, analyze, improve, digitize and monitor your business processes, risks, regulatory requirements and performance indicators within Interfacing’s Digital Twin integrated management system the Enterprise Process Center®!

Trusted by Customers Worldwide!

More than 400+ world-class enterprises and management consulting firms