- Business Process Management (BPM)Document Management System (DMS)Electronic Quality Management System (QMS)Risk, Governance & Compliance (GRC)Low Code Rapid Application Development (LC)Business Continuity Management (BCM)Enterprise Architecture (EA)Business Process Management (BPM)Document Management System (DMS)

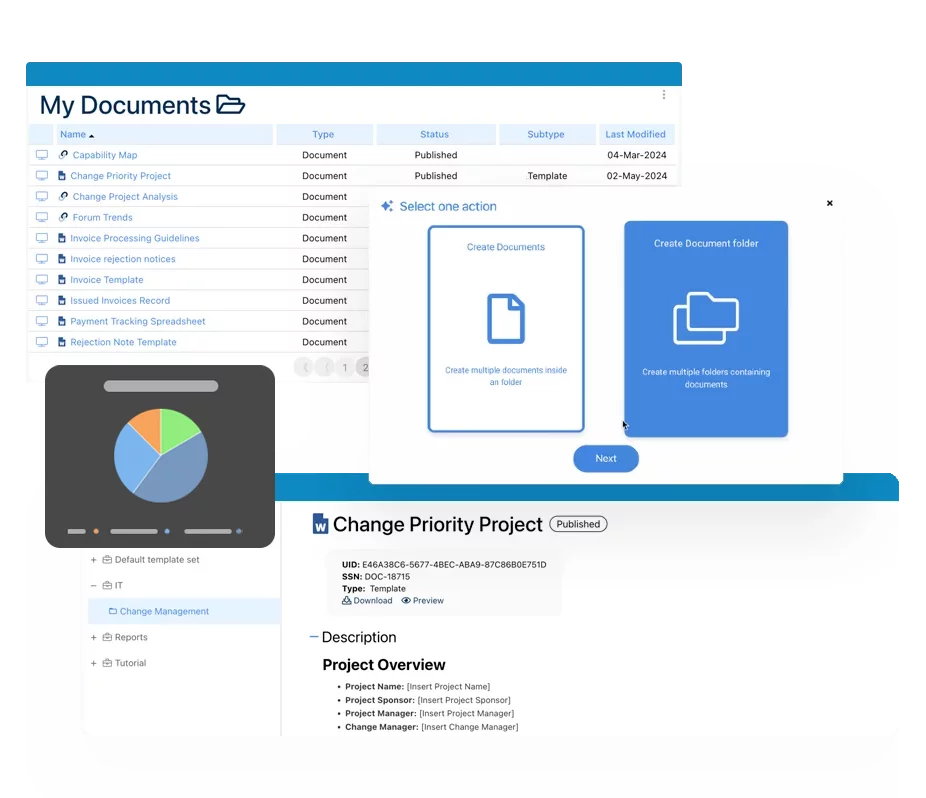

- Document Control Overview

- AI Content Creation & Improvement

- Policy & Procedure Management (SOP)

- AI Content Mining Parser

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

Electronic Quality Management System (QMS)

Electronic Quality Management System (QMS)- Quality Management System Overview

- Document Control & Records Management

- Audit & Accreditation Management

- Corrective & Preventative Action

- Quality Event (Non-conformity / Complaint/ Compliance)

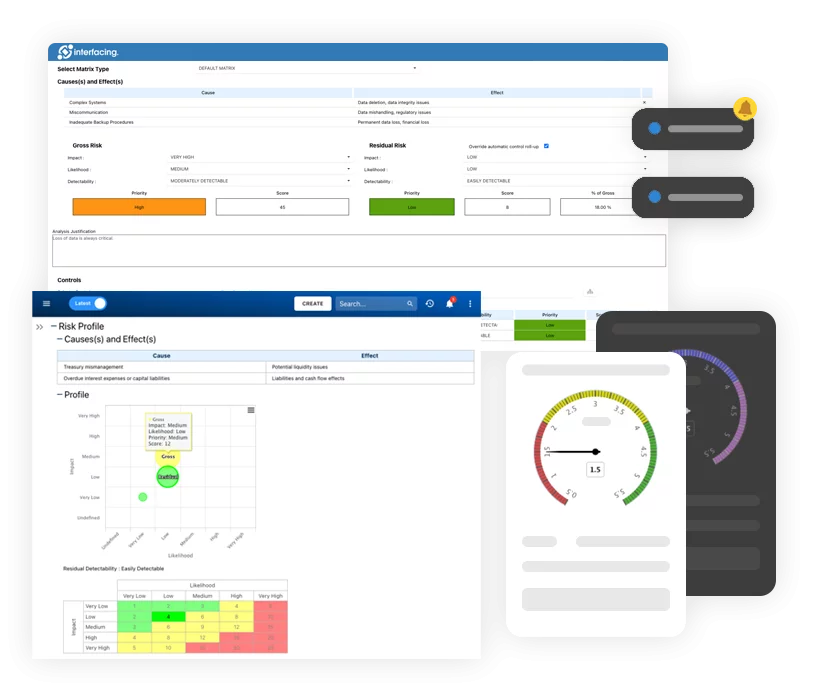

- Risk Management

- Incident Management

- Environmental Health & Safety

- Product & Supplier Management (SCAR)

- Training Management

- Control Management

- Action Items Management

- Management Review

- FMEA

- Pharmacovigilance

- Data Migration & Integration

Risk, Governance & Compliance (GRC)

Risk, Governance & Compliance (GRC)- Risk, Governance & Compliance Overview

- Risk & Control Management

- Regulatory Compliance

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

Low Code Rapid Application Development (LC)

Low Code Rapid Application Development (LC)- Low Code Automation Platform Overview

- Electronic Web Form Design (eFORMS)

- Database Table Entity Designer

- System Integration Designer

- Design & Manage Tasks

- Design & Manage BPMS Apps

- Custom Rules/Guards/Actions

- Electronic Services

- User Homepage

- BAM (Business Activity Monitoring)

- Custom Dashboard Design

- Data Migration & Integration

Business Continuity Management (BCM)

Business Continuity Management (BCM)- Business Continuity Management Overview

- Business Impact Analysis

- Disaster Recovery Simulation

- Action Item Management

- Mass Notification Management

- Asset Management

- Interfacing Offline App

Enterprise Architecture (EA)

Enterprise Architecture (EA) - IndustriesRegulatory ComplianceUse CasesLearning CenterFramework & PracticesIndustries

- Healthcare

- Medical Device Technology

- Life Science, Pharmaceutical

- Aerospace & Defense

- Airlines and Aviation

- Media & Telecommunications

- Government and Military

- Technology

- Energy

- Logistics & Port Operations

- Banking & Capital Markets

- Retail & Consumer

- Consulting

- Education

- Engineering & Construction

- Manufacturing

- Financial Services

- Insurance

- Chemicals

Regulatory Compliance- Regulatory Compliance

- ISO

- ISO 9001 (guide)

- ISO 9001:2026 (preparation)

- ISO 17025

- ISO 27000

- ISO 27001

- ISO27002

- ISO 42001

- EU AI Act

- SOC 2 Type 1 & 2

- Sarbanes Oxley

- GxP

- GRC

- Basel

- Digital Signature

- GDPR

- IFRS

- NIST SP 800-53

Use Cases

Use Cases- Quality Management System (QMS)

- Digital Transformation

- Continuous Improvement

- Governance, Risk & Compliance

- Knowledge Management

- System Deployment (ERP, CRM…)

Learning CenterFramework & Practices

Learning CenterFramework & Practices - AboutCustomer SuccessPartners

IFRS - International Financial Reporting Standards

Please Select contact form.

A simple approach

IFRS Conceptual Framework

The adoption of IFRS Standards requires businesses to take a proactive role to achieve compliance. In order to do so, companies in every industry are using Business Process Management (BPM) to implement the change.

A closer look at the advantages of IFRS conceptual framework & IFRS Standards

Ensure Transparency

Know where resources are being used and encourage efficient work and habits by planning well in advance

Orchestrate Technology

Implement service orchestration to design more flexible communications networks that mirror the efficency of your business process management

Manage Workflow

Integrate your people, processes, and technology by taking advantage of our workflow engine to deliver work to where it’s needed, and keep all employees up to date with the most important priorities

Printable Process Manuals

Ability to generate a complete output of your processes and all of the related information that is ready for print. A collaborative tool that allows your agents to share information more widely

Implement Standard Methodologies

Avoid the needed for continual trial and error in improving your client’s operational efficiency; get a head start by taking advantage of industry standards

Compliance

Our process methodology and support for business rules and risk/control management allows effective process design that has all the appropriate checks and balances

Encourage Collaboration

By uniting goals and creating a common framework for your clients, they will be able to cooperate at a previously unattained level.

Utilize Resources

Business process management will expose unused resources and allow you to take better advantage of them along the length of the process

Meeting IFRS Compliance Requirements

The International Financial Reporting Standards (IFRS) are a core set of accounting standards that are being adopted by countries around the world. The globalization of business and finance has created the need for a common set of accounting standards to be used by all countries as a way to increase the efficiency of cross-border transaction handling and accountability. The need to implement IFRS has highlighted the utility of BPM technology as the increasing number of compliance initiatives poses numerous challenges for companies of all sizes. The high cost of non-compliance is a risk that companies cannot afford to take. With BPM technology, compliance initiatives become ingrained in every company process, leaving no room for error.

With backing from the SEC, the International Organization of Securities Commissions, and the International Accounting Standards Board, IFRS will soon be a mandatory requirement for businesses in every country. To date, more than 12,000 companies in over 100 countries have adopted IFRS.

What Is Your Company Doing About IFRS?

New IFRS accounting processes can be modeled using Interfacing’s BPM suite, the Enterprise Process Center®, and can be easily distributed across your enterprise with the click of a button. EPC’s workflow engine can automate the process, reducing the amount of manual labour required by employees. Controls can be implemented and associated with tasks, ensuring that every necessary step is taken in order to comply with IFRS. The Enterprise Process Center’s audit features track any changes to company processes, rules, documents, and controls. Audit plans can be created, automated, and saved for future use, taking the pain out of an audit process.

Overall, the EPC gives every company the ability to effectively manage all of their compliance initiatives from ISO to IFRS. Decreasing operating costs becomes difficult as compliance requirements increase. This, however, does not need to be the case. Use the Enterprise Process Center® today to easily and effectively map, implement, and manage your compliance initiatives, reducing the associated risks of non-compliance.

Beyond Financial Reporting

Although only a financial reporting standard, IFRS will surely affect every aspect of your company. As stated by the American Institute of Certified Public Accountants, “[IFRS]… will have an impact far beyond just financial reports. It will affect almost every aspect of a […] company’s operations, everything from its information technology systems, to its tax reporting requirements, to the way it tracks stock-based compensation.”

Mapping your processes using Enterprise Process Center® allows you to visualize every company process. The EPC will highlight every possible process component that will be affected by the implementation of IFRS, ensuring a proactive solution to change. Overlooking process areas that are affected by the implementation of IFRS can result in severe penalties and process inefficiency. Reduce this risk and implement an effective, cost reducing IFRS program with the help of the Enterprise Process Center.

Why Choose Interfacing?

With over two decades of AI, Quality, Process, and Compliance software expertise, Interfacing continues to be a leader in the industry. To-date, it has served over 500+ world-class enterprises and management consulting firms from all industries and sectors. We continue to provide digital, cloud & AI solutions that enable organizations to enhance, control and streamline their processes while easing the burden of regulatory compliance and quality management programs.

To explore further or discuss how Interfacing can assist your organization, please complete the form below.

Documentation: Driving Transformation, Governance and Control

• Gain real-time, comprehensive insights into your operations.

• Improve governance, efficiency, and compliance.

• Ensure seamless alignment with regulatory standards.

eQMS: Automating Quality & Compliance Workflows & Reporting

• Simplify quality management with automated workflows and monitoring.

• Streamline CAPA, supplier audits, training and related workflows.

• Turn documentation into actionable insights for Quality 4.0

Low-Code Rapid Application Development: Accelerating Digital Transformation

• Build custom, scalable applications swiftly

• Reducing development time and cost

• Adapt faster and stay agile in the face of

evolving customer and business needs.

AI to Transform your Business!

The AI-powered tools are designed to streamline operations, enhance compliance, and drive sustainable growth. Check out how AI can:

• Respond to employee inquiries

• Transform videos into processes

• Assess regulatory impact & process improvements

• Generate forms, processes, risks, regulations, KPIs & more

• Parse regulatory standards into requirements

Request Free Demo

Document, analyze, improve, digitize and monitor your business processes, risks, regulatory requirements and performance indicators within Interfacing’s Digital Twin integrated management system the Enterprise Process Center®!

Trusted by Customers Worldwide!

More than 400+ world-class enterprises and management consulting firms