- Business Process Management (BPM)Document Management System (DMS)Electronic Quality Management System (QMS)Risk, Governance & Compliance (GRC)Low Code Rapid Application Development (LC)Business Continuity Management (BCM)Enterprise Architecture (EA)Business Process Management (BPM)Document Management System (DMS)

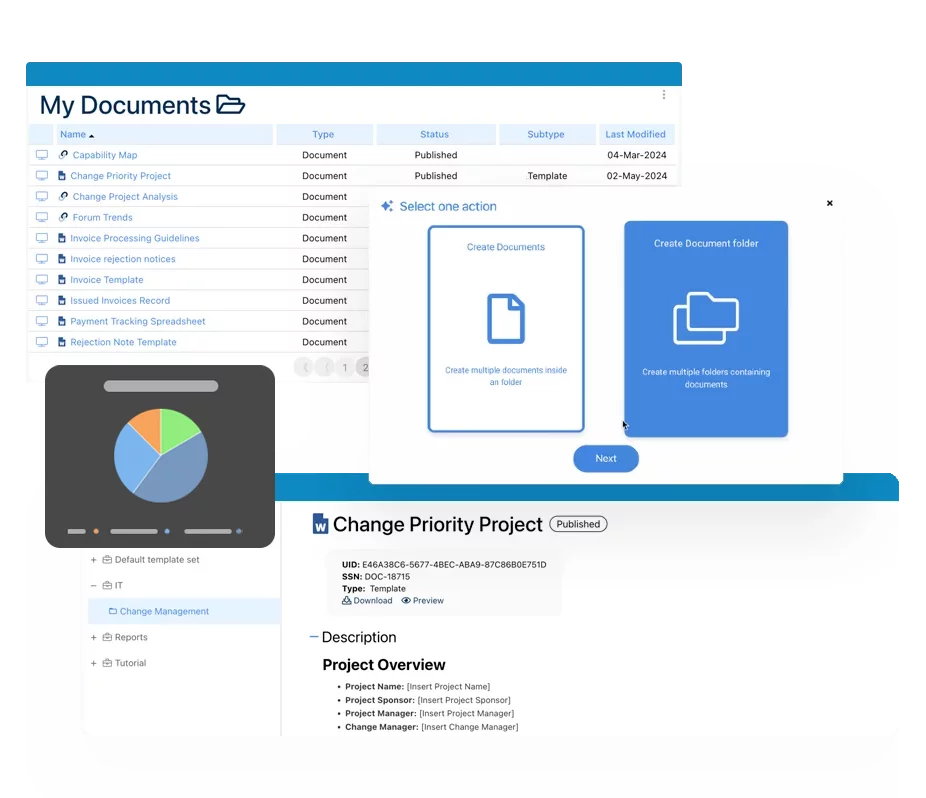

- Document Control Overview

- AI Content Creation & Improvement

- Policy & Procedure Management (SOP)

- AI Content Mining Parser

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

Electronic Quality Management System (QMS)

Electronic Quality Management System (QMS)- Quality Management System Overview

- Document Control & Records Management

- Audit & Accreditation Management

- Corrective & Preventative Action

- Quality Event (Non-conformity / Complaint/ Compliance)

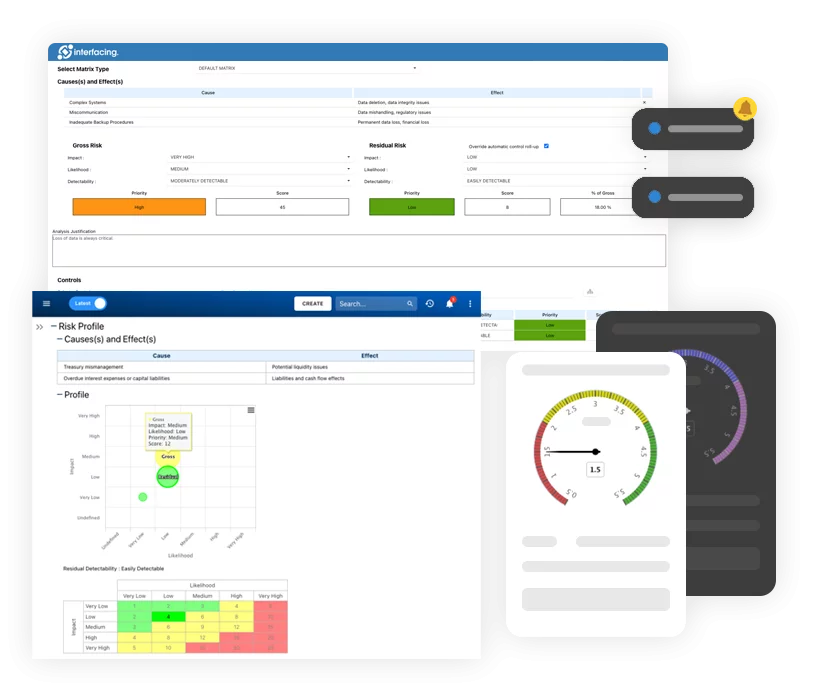

- Risk Management

- Incident Management

- Environmental Health & Safety

- Product & Supplier Management (SCAR)

- Training Management

- Control Management

- Action Items Management

- Management Review

- FMEA

- Pharmacovigilance

- Data Migration & Integration

Risk, Governance & Compliance (GRC)

Risk, Governance & Compliance (GRC)- Risk, Governance & Compliance Overview

- Risk & Control Management

- Regulatory Compliance

- Collaboration & Governance

- Data Migration & Integration

- Interfacing Offline App

Low Code Rapid Application Development (LC)

Low Code Rapid Application Development (LC)- Low Code Automation Platform Overview

- Electronic Web Form Design (eFORMS)

- Database Table Entity Designer

- System Integration Designer

- Design & Manage Tasks

- Design & Manage BPMS Apps

- Custom Rules/Guards/Actions

- Electronic Services

- User Homepage

- BAM (Business Activity Monitoring)

- Custom Dashboard Design

- Data Migration & Integration

Business Continuity Management (BCM)

Business Continuity Management (BCM)- Business Continuity Management Overview

- Business Impact Analysis

- Disaster Recovery Simulation

- Action Item Management

- Mass Notification Management

- Asset Management

- Interfacing Offline App

Enterprise Architecture (EA)

Enterprise Architecture (EA) - IndustriesRegulatory ComplianceUse CasesLearning CenterFramework & PracticesIndustries

- Healthcare

- Medical Device Technology

- Life Science, Pharmaceutical

- Aerospace & Defense

- Airlines and Aviation

- Media & Telecommunications

- Government and Military

- Technology

- Energy

- Logistics & Port Operations

- Banking & Capital Markets

- Retail & Consumer

- Consulting

- Education

- Engineering & Construction

- Manufacturing

- Financial Services

- Insurance

- Chemicals

Regulatory Compliance- Regulatory Compliance

- ISO

- ISO 9001 (guide)

- ISO 9001:2026 (preparation)

- ISO 17025

- ISO 27000

- ISO 27001

- ISO27002

- ISO 42001

- EU AI Act

- SOC 2 Type 1 & 2

- Sarbanes Oxley

- GxP

- GRC

- Basel

- Digital Signature

- GDPR

- IFRS

- NIST SP 800-53

Use Cases

Use Cases- Quality Management System (QMS)

- Digital Transformation

- Continuous Improvement

- Governance, Risk & Compliance

- Knowledge Management

- System Deployment (ERP, CRM…)

Learning CenterFramework & Practices

Learning CenterFramework & Practices - AboutCustomer SuccessPartners

Financial Services

Please Select contact form.

Ensure accountability, accelerate innovation, and maintain regulatory alignment across your financial operations with Interfacing’s AI-powered QMS and BPM platform.

Consulting for Finance Services Process Management

Interfacing helps financial institutions navigate compliance and governance challenges through AI-powered automation.

Financial organizations face complex challenges: evolving global regulations (Basel III, IFRS, AML/KYC), pressure to deliver digital-first services, and the need for transparent governance.

Interfacing helps banks, insurers, asset managers, and fintechs digitize and automate governance processes—ensuring compliance, minimizing risk, and increasing operational speed. Our AI-powered platform enables intelligent documentation, real-time visibility, and seamless collaboration across departments and jurisdictions.

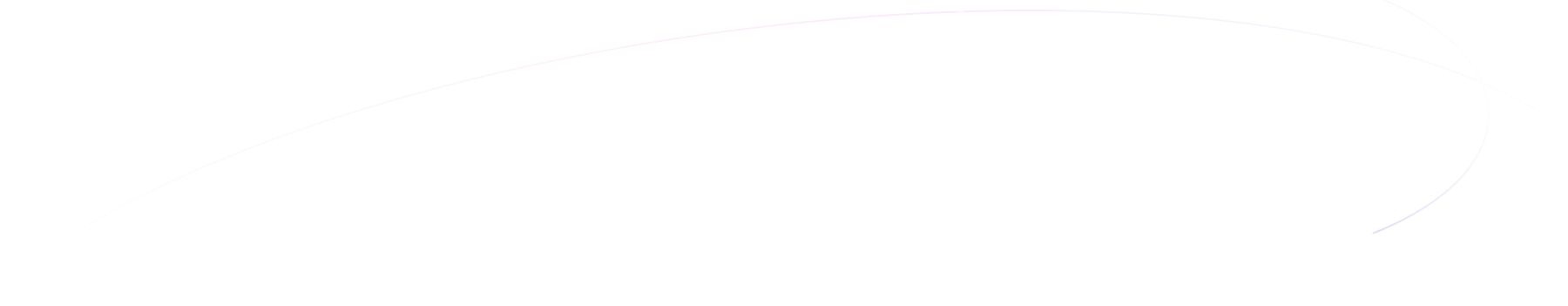

AI-Driven Process Discovery

Automatically map current-state processes across business units and identify inefficiencies in areas like loan origination, KYC onboarding, or claims handling.

Regulation-Aware SOP & Policy Generation

AI analyzes regulatory updates (e.g., Basel III, IFRS, Dodd-Frank) and recommends content updates to relevant procedures and controls, ensuring you remain compliant at all times.

Audit-Ready Documentation & Evidence Control

Automate the creation and maintenance of version-controlled documentation with full traceability for auditors and regulators.

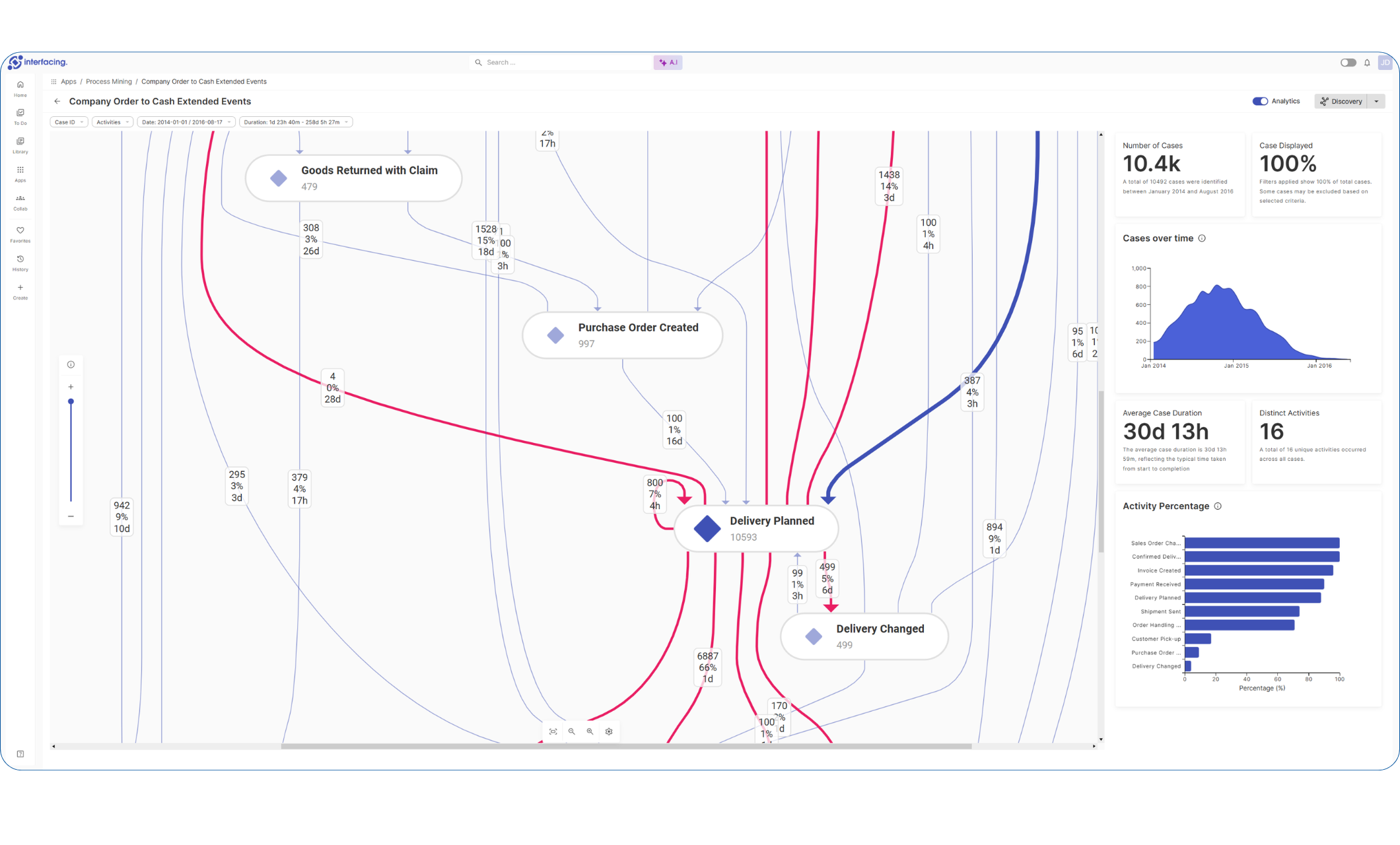

Centralized Risk & Control Monitoring

Monitor key risk indicators and control effectiveness in real-time. AI flags deficiencies and enables faster incident resolution.

Smart Workflow Assistance

Integrate contextual guidance into compliance forms and processes, reducing reliance on manual oversight and tribal knowledge.

Financial Services Process Management

Ensure transparency

Know where resources are being used and maintain efficient work habits by planning well in advance.

Model Business Rules

Our approach to financial / banking Process Management allows your company to easily implement business rules that can be reused and easily updated along the length of your processes.

Create portable Process Manuals

Ability to generate a complete output of your processes and all of the related information that is ready for print. An excellent collaborative tool that allows your employees to share information widely.

Implement standard methodologies

Avoid the need for continual trial and error in improving your agency’s operational efficiency; get a head start by taking advantage of industry standards.

SOX Compliance

Our process methodology and support for business rules and risk/control management allows effective process design that has all the appropriate checks and balances.

Manage Workflow

Our workflow engine allows you to deliver work where it is needed, by integrating your people, processes and technology and keeping employees updated with important priorities.

Encourage collaboration

By uniting goals and creating a common framework for your agents, they will be able to cooperate at a previously unattained level.

Utilize resources

Business process management will expose unused resources and allow you to take better advantage of them along the length of the process.

"

The Importance of Consistant of Customer Service

World-class service and complete transparency are the keystones for success in this niche. It is very important to offer highly personalized client relationships, which can result in inordinate attention being spent on details, curbing your ability to cater to a number of clients. With support from the EPC, focus can be brought to segmentation strategies that are ideal for your growth and success. At the same time, the improved efficiency within your business makes it possible to maintain firm control over costs. Automate tasks and processes that are routine so that your team can invest time in improving the quality of deliverables and pay more attention to customer satisfaction. Focus on due diligence, account creation and customer database management without needing to invest valuable resources in these tasks. Maintain leading levels of customer service without taking on additional costs and ensure that you are geared to quickly address emerging customer preferences with the support of our proven BPM solutions. Discuss your needs with us today and we will tell you how the EPC can ensure a marked positive difference in many key areas.

"

Challenges

Whether your focus is on account overviews, customer relationship life-cycle management, case management or marketing, the financial services landscape presents many challenges. These challenges grow to unmanageable proportions unless you have complete control over all your processes within every segment of your organization. The EPC improves your efficacy at every level by identifying flawed process cycles, establishing process transformation where required and integrating more efficient processes where necessary.

"

Add Value

Compliance with regulatory frameworks is a critical area common to all three parts of the industry where our BPM solutions add immense value. Using our process mapping tools, we establish standardized process flows that make it easy for all employees to maintain required quality output and high productivity levels without compromising on compliance.

How Interfacing Helps

- Comply with global regulations such as Basel III, IFRS, AML/KYC, FATCA, and ESG

- Automate risk and control documentation with AI-generated evidence

- Enable faster approvals and internal audits with low-code workflows

- Digitize process handbooks, policies, and exception handling procedures

- Maintain continuous audit readiness across regions and regulators

Why Choose Interfacing?

With over two decades of AI, Quality, Process, and Compliance software expertise, Interfacing continues to be a leader in the industry. To-date, it has served over 500+ world-class enterprises and management consulting firms from all industries and sectors. We continue to provide digital, cloud & AI solutions that enable organizations to enhance, control and streamline their processes while easing the burden of regulatory compliance and quality management programs.

To explore further or discuss how Interfacing can assist your organization, please complete the form below.

Documentation: Driving Transformation, Governance and Control

• Gain real-time, comprehensive insights into your operations.

• Improve governance, efficiency, and compliance.

• Ensure seamless alignment with regulatory standards.

eQMS: Automating Quality & Compliance Workflows & Reporting

• Simplify quality management with automated workflows and monitoring.

• Streamline CAPA, supplier audits, training and related workflows.

• Turn documentation into actionable insights for Quality 4.0

Low-Code Rapid Application Development: Accelerating Digital Transformation

• Build custom, scalable applications swiftly

• Reducing development time and cost

• Adapt faster and stay agile in the face of

evolving customer and business needs.

AI to Transform your Business!

The AI-powered tools are designed to streamline operations, enhance compliance, and drive sustainable growth. Check out how AI can:

• Respond to employee inquiries

• Transform videos into processes

• Assess regulatory impact & process improvements

• Generate forms, processes, risks, regulations, KPIs & more

• Parse regulatory standards into requirements

Request Free Demo

Document, analyze, improve, digitize and monitor your business processes, risks, regulatory requirements and performance indicators within Interfacing’s Digital Twin integrated management system the Enterprise Process Center®!

Trusted by Customers Worldwide!

More than 400+ world-class enterprises and management consulting firms