A unified European framework transforming how financial institutions govern ICT risk, operational resilience, and third-party oversight.

Understanding DORA in Practical Terms

The Digital Operational Resilience Act represents one of the EU’s most ambitious attempts to modernize financial-sector governance. Rather than layering yet another set of cybersecurity rules on top of existing frameworks, DORA consolidates the operational backbone of financial organizations—technology, risk, continuity, and third-party oversight—into a single regulatory model.

At its core, DORA is about demonstrating that the institution can continue to operate even when technology fails. Not just by having backups or basic security controls, but by proving a deep, structural understanding of how business services rely on systems, data, vendors, and people.

Many organizations assume they are “mostly ready” because they have ISO 27001 or an established cybersecurity program. This assumption breaks down quickly. DORA’s scope extends far beyond cyber practices: it reaches into governance, scenario-based resilience testing, incident classification models, contractual standards with third parties, and the traceability of operational dependencies. It forces organizations to articulate, in defensible detail, how they will stay operational when critical technology stops working.

Gestion proactive des risques et continuité des activités

La véritable résilience est le fruit d’une identification, d’une simulation et d’une atténuation proactives des risques.

InterfacingLes modules de gestion des risques et des contrôles et de planification de la continuité des activités permettent une modélisation prédictive des risques, des simulations de scénarios et des flux de travail CAPA automatisés.

Ces capacités offrent une visibilité unifiée et en temps réel de l’exposition au risque, ce qui est crucial pour les équipes interfonctionnelles qui travaillent dans plusieurs départements et sur plusieurs fuseaux horaires.

Sécurisé, validé et conçu pour être mis à l’échelle

Interfacing offre un environnement validé et sécurisé auquel les entreprises internationales font confiance. Les fonctionnalités comprennent les signatures numériques cryptées, les pistes d’audit, le contrôle des versions et la conformité au CRF Part 11.

Son analyseur de documents IA et son moteur NLP exclusifs garantissent que les mises à jour ne sont jamais manquées et que les anomalies sont rapidement signalées. Des modules de formation et des journaux de confirmation de lecture permettent aux utilisateurs de rester informés.

Construit sur une plateforme à code bas, Interfacing prend en charge la configuration rapide de nouveaux cas d’utilisation, ce qui est idéal pour les organisations dynamiques qui évoluent.

Comment Interfacing peut vous aider

Interfacing ne se contente pas d’offrir des outils, il propose une plateforme stratégique qui réunit la gestion des risques, de la conformité et de la performance.

Découvrez notre gamme complète de capacités alimentées par l’IA à l’adresse suivante : https://interfacing.com/artificial-intelligence

Du suivi intelligent des changements réglementaires à l’exploration et à l’automatisation des processus, Interfacing permet à votre entreprise de transformer les risques en opportunités.

À une époque de changements constants et de pressions croissantes, les stratégies de conformité statiques ne sont plus viables.

L’IA offre une meilleure voie – proactive, prédictive et précise. Interfacing aide les organisations à construire des systèmes plus intelligents qui s’adaptent, répondent et dirigent.

Les entreprises prêtes pour l’avenir ne se contentent pas de gérer les risques, elles les maîtrisent.

Who Is Actually Covered by DORA?

Although framed as a financial-sector regulation, DORA’s influence extends far beyond banks. It applies across the financial ecosystem—insurance, investment firms, asset managers, payment providers, crypto-asset service providers—and, importantly, to critical ICT service providers that support them.

This means the compliance burden is shared between institutions and the technology vendors they rely on. Cloud providers, software platforms, and managed service organizations supporting critical functions now fall within the regulatory line of sight. For the first time, ICT firms that once operated outside direct financial regulation may face EU-level scrutiny regarding resilience, continuity, and incident transparency.

What DORA Actually Requires (Beyond the Text of the Regulation)

DORA’s requirements are often summarized as a checklist—risk management, incident reporting, resilience testing, third-party oversight—but in practice, these components function as an interconnected ecosystem.

Institutions must articulate how ICT risks are governed, monitored, mitigated, and escalated. They must classify incidents consistently and report severe events using standardized timelines. They must plan, test, and validate their resilience capabilities, not only through tabletop exercises but through scenario-based simulations and, for larger institutions, threat-led penetration testing.

Perhaps the most complex requirement involves third-party oversight. Organizations must understand not only who their vendors are, but what dependencies those vendors create, how failures would cascade through operations, and what assurance exists that those providers can withstand disruptions of their own.

None of these activities can occur in isolation. A continuity plan that is not aligned with process owners and technology inventories will fail under stress. Vendor assessments that are not linked to operational impact will not satisfy regulators. Risk registers that live in spreadsheets cannot demonstrate real-time governance. DORA requires an operational model that is integrated, traceable, and explainable.

Preparing for DORA: The Shift from Documents to Evidence

Organizations preparing for DORA often begin by reviewing their documentation. But DORA is not a documentation exercise. It is an evidence exercise. Regulators are not interested in whether policies exist; they care whether the organization lives by them.

This means institutions must be able to show how business processes depend on ICT assets, how controls are applied and monitored, how incidents evolve and escalate, and how continuity strategies correspond to operational realities. It means understanding how a failure in a single vendor or system would affect the larger value chain—and having a defensible answer for how the institution would maintain service.

Most gaps are not technical—they are structural. Dependencies are not documented in a unified way. Incident logs are inconsistent. Ownership responsibilities differ between teams. Risk and continuity speak different languages. Vendor files are static and not aligned with operational impact.

Preparing for DORA requires building connective tissue between these elements. Institutions that succeed typically adopt an integrated management system approach, where operational data lives in one governed framework rather than scattered across individual departments.

The Real-World Challenges Institutions Face

In practice, the hardest part of DORA compliance is not meeting the technical expectations—it is establishing transparency across the organization.

Institutions often discover that their internal view of operations does not match reality. Processes rely on undocumented systems. Systems rely on vendors that procurement has not reviewed in years. Continuity plans assume capabilities that no longer exist. Risk assessments reference outdated controls.

The problem is not bad practice—it is that operational complexity has grown faster than governance structures. DORA forces a recalibration. It compels organizations to replace assumptions with evidence, and narratives with traceability.

This is why DORA is transformative: it forces institutions to understand themselves in ways they never had to before.

Where AI Strengthens DORA Resilience

AI becomes particularly useful in areas where manual governance breaks down. It can detect gaps in documentation, highlight missing links between systems and processes, classify incidents consistently, and analyze regulatory updates to identify relevant impacts. When used effectively, AI reveals structural weaknesses that would otherwise remain hidden.

However, AI does not replace governance—it amplifies it. Institutions still need structure, ownership, and controlled workflows. AI simply accelerates the discovery and validation of the elements regulators expect to see.

How Interfacing Helps Organizations Meet DORA Requirements

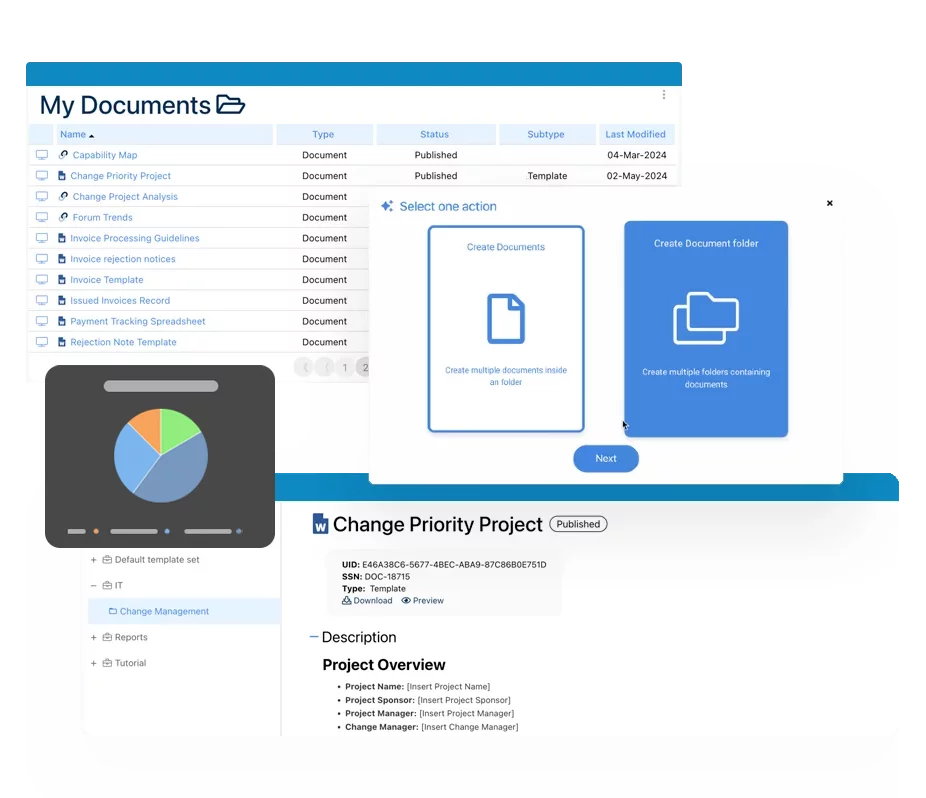

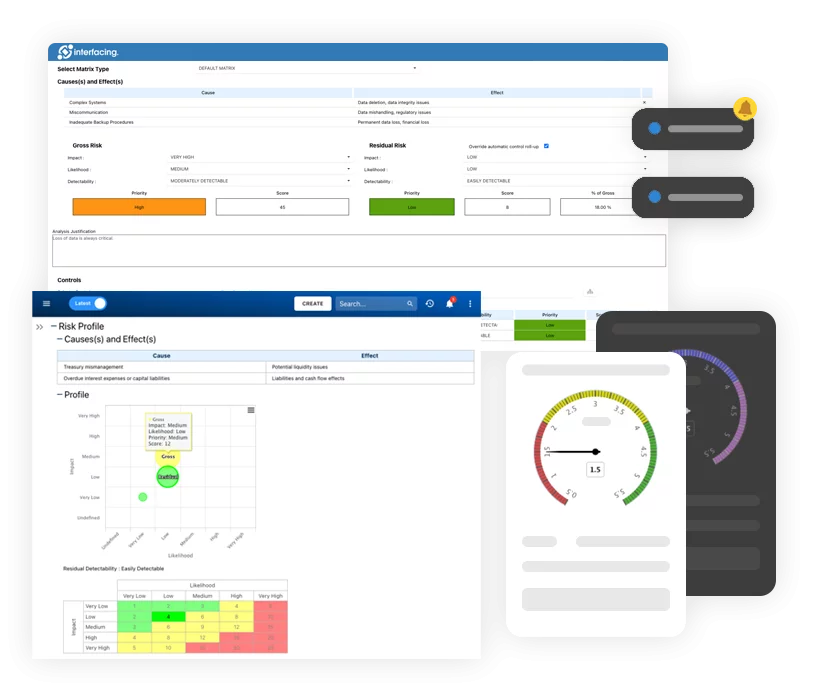

Interfacing’s AI-powered Integrated Management System (IMS) provides the unified structure that DORA expects. It connects processes, risks, controls, assets, vendors, documents, and continuity plans within a single governed framework. This eliminates the fragmentation that makes DORA compliance difficult.

With Interfacing, organizations can map their digital ecosystem, visualize dependencies, automate workflows, classify and escalate incidents, manage evidence, and build an audit-ready operational picture. The platform supports everything from impact analysis to board-level reporting, ensuring that what regulators ask for is always traceable, current, and defensible.

Instead of piecing together DORA compliance across multiple disconnected systems, institutions operate from a single source of truth—strengthening resilience while reducing the burden of ongoing compliance.

Request Demo

https://interfacing.com/ai-integrated-management-system

Pourquoi choisir Interfacing?

Avec plus de deux décennies de logiciels d'IA, de qualité, de processus et de conformité, Interfacing continue d'être un leader dans l'industrie. À ce jour, nous avons servi plus de 500+ entreprises de classe mondiale et des sociétés de conseil en gestion de toutes les industries et de tous les secteurs. Nous continuons à fournir des solutions numériques, cloud et IA qui permettent aux organisations d'améliorer, de contrôler et de moderniser leurs processus tout en allégeant le fardeau de la conformité réglementaire et des programmes de gestion de la qualité.

Pour en savoir plus ou discuter de la manière dont Interfacing peut aider votre organisation, veuillez remplir le formulaire ci-dessous.

Documentation : Piloter la transformation, la gouvernance et le contrôle

• Obtenez des informations complètes et en temps réel sur vos opérations.

• Améliorez la gouvernance, l'efficacité et la conformité.

• Assurez une conformité fluide avec les normes réglementaires.

eQMS : Automatiser les workflows de qualité et de conformité & rapports

• Simplifiez la gestion de la qualité avec des workflows automatisés et une traçabilité continue.

• Standardisez la gestion des CAPA, des audits fournisseurs, de la formation et des workflows associés.

• Transformez la documentation en informations exploitables pour la Qualité 4.0.

Développement rapide d'applications low-code : Accélérer la transformation numérique

• Créez rapidement des applications personnalisées et évolutives.

• Réduisez le temps et les coûts de développement.

• Adaptez-vous rapidement pour répondre aux besoins évolutifs des clients et de votre entreprise.

L’IA pour transformer votre entreprise !

Conçus pour optimiser les opérations, l'efficacité et renforcer la conformité. Découvrez nos solutions alimentés par l’IA :

• Répondre aux questions des employés.

• Transformer des vidéos en processus.

• Recommander des améliorations de processus et des impacts réglementaires.

• Générer des formulaire, processus, risques, réglementations, KPIs, et bien plus.

• Fragmenter les normes réglementaires

Request Free Demo

Document, analyze, improve, digitize and monitor your business processes, risks, regulatory requirements and performance indicators within Interfacing’s Digital Twin integrated management system the Enterprise Process Center®!

Approuvé par nos clients à travers le monde !

Plus de 400 entreprises de classe mondiale et cabinets de conseil en gestion.

INTEGRATION

Approuvé par les nos clients dans le monde entier !

Plus de 400 entreprises de classe mondiale et cabinets de conseil en gestion.